USDA loan refinance: Flexible Solutions for Lowering Your Loan Term.

Wiki Article

Achieve Lower Settlements: Necessary Insights on Lending Refinance Options

Funding refinancing presents a critical chance for property owners looking for to lower their regular monthly settlements and total economic responsibilities. By analyzing various refinance options, such as rate-and-term and cash-out refinancing, individuals can customize options that line up with their specific monetary situations. Nevertheless, the decision to refinance includes mindful factor to consider of market problems, individual finances, and lender comparisons to absolutely maximize possible benefits. As we discover these components, one might wonder: what crucial variables could either enhance or threaten the refinancing procedure?Comprehending Lending Refinancing

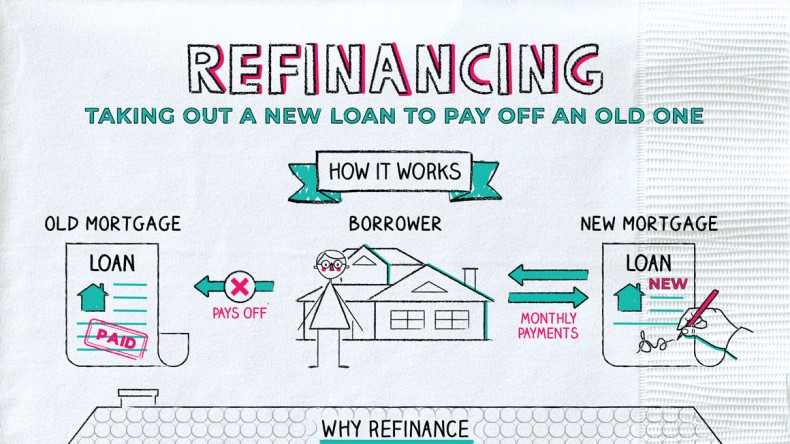

Loan refinancing is an economic method that enables borrowers to replace their existing lendings with new ones, typically to secure much more desirable terms. This procedure can result in lower rates of interest, minimized monthly repayments, or a various funding duration that far better aligns with the consumer's monetary goals.

The main inspiration behind refinancing is to improve economic versatility. By examining existing market conditions, customers might find that rate of interest have decreased given that their initial finance was taken out, which could cause considerable financial savings with time. Furthermore, refinancing can supply possibilities to consolidate debt, changing numerous high-interest obligations right into a single workable repayment.

In addition, debtors might pick to re-finance to accessibility equity developed in their homes, which can be used for numerous objectives such as home improvements or education expenditures. It is important to think about the connected costs of refinancing, such as closing charges and other expenses, which can balance out possible cost savings. Examining one's monetary situation and long-lasting objectives is crucial prior to devoting to refinancing. By meticulously evaluating the benefits and expenses, debtors can make enlightened choices that align with their total economic technique.

Types of Refinance Options

Re-financing deals numerous alternatives customized to fulfill diverse financial demands and goals. One of the most usual kinds include rate-and-term refinancing, cash-out refinancing, and streamline refinancing.Rate-and-term refinancing enables customers to readjust the passion price, financing term, or both, which can bring about lower month-to-month settlements or lowered total rate of interest prices. This option is typically gone after when market prices go down, making it an appealing choice for those wanting to save money on rate of interest.

Cash-out refinancing makes it possible for home owners to access the equity in their residential or commercial property by obtaining greater than the existing home loan equilibrium. The distinction is taken as cash, supplying funds for significant expenses such as home improvements or financial obligation consolidation. However, this option increases the total financing amount and might impact long-term financial security.

Each of these refinancing types provides unique benefits and factors to consider, making it necessary for debtors to examine their particular monetary situations and objectives prior to continuing.

Benefits of Refinancing

Refinancing can use several economic advantages, making it an appealing option for lots of. If market rates have decreased given that the original home loan was secured, house owners may re-finance to acquire a lower rate, which can lead to reduced month-to-month payments and considerable savings over the car loan's term.In addition, refinancing can assist house owners accessibility equity in their residential property. By choosing a cash-out refinance, they can convert a part of their home equity right into money, which can be utilized for home enhancements, debt loan consolidation, or various other financial requirements.

Another benefit is the opportunity to transform the lending terms. Homeowners can change from a variable-rate mortgage (ARM) to a fixed-rate home mortgage for higher stability, or reduce the finance term to settle the mortgage faster and reduce passion prices.

Aspects to Take Into Consideration

Prior to choosing to re-finance a home mortgage, property owners ought to very carefully assess a number of key factors that can substantially influence their financial scenario. The existing passion prices in the market should be analyzed; refinancing is typically helpful when prices are lower than the existing home loan rate. Additionally, it is vital to consider the continuing to be term of the current mortgage, as expanding the term can cause paying even more rate of interest in time, in spite of reduced regular monthly payments.

Lastly, property owners must analyze their lasting economic goals. If preparing to relocate the future, refinancing may not be the most effective alternative (USDA loan refinance). By thoroughly considering these factors, house owners can make informed choices that straighten with their monetary objectives and general security

Steps to Refinance Your Lending

When house owners have examined the essential aspects influencing their decision to re-finance, they can continue with the essential actions to finish the process. The initial step is to establish the sort of refinance that best suits their financial goals, whether it be see this here a rate-and-term refinance or a cash-out refinance.Next, property owners ought to collect all pertinent economic papers, including revenue declarations, tax returns, and info regarding existing financial obligations. This documents will be essential when applying for a brand-new lending.

linked here As soon as an ideal lending institution is selected, home owners can send their application. The loan provider will certainly perform a detailed evaluation, which may include an assessment of the home.

After approval, house owners will receive a Closing Disclosure detailing the regards to the new financing. Finally, upon closing, the brand-new loan will pay off the existing home loan, and home owners can start appreciating the advantages of their refinanced finance, consisting of lower regular monthly settlements or accessibility to cash money.

Conclusion

In conclusion, car loan refinancing provides an important opportunity for homeowners to achieve reduced payments and ease economic stress and anxiety - USDA loan refinance. By comprehending different refinance alternatives, such as rate-and-term, cash-out, and improve refinancing, people can make informed directory decisions customized to their financial circumstances.Report this wiki page